In the United Kingdom. From 1st April 2022 all VAT registered business regardless of turnover have to use software that is MTD compliant to file their VAT returns. Adminsoft Accounts is MTD compliant for VAT.

Please click here for further details. MTD for Self Assessment has now been kicked back by HMRC to April 2026 at the earliest.

For software that works not just in the United Kingdom, but most countries across the world:

|

What people have been saying about Adminsoft Accounts

|

|

The book on accounting and bookkeeping based on Adminsoft Accounts called 'Free Accounting with Free Software', written by Yogesh Patel.

|

|

PC based accounting or on-line accounting?

|

| All you need to run your business....

|

|

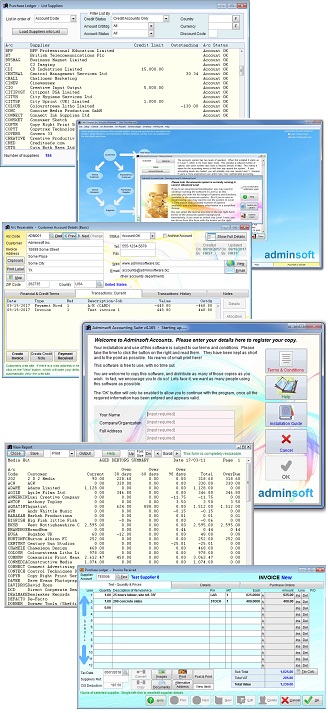

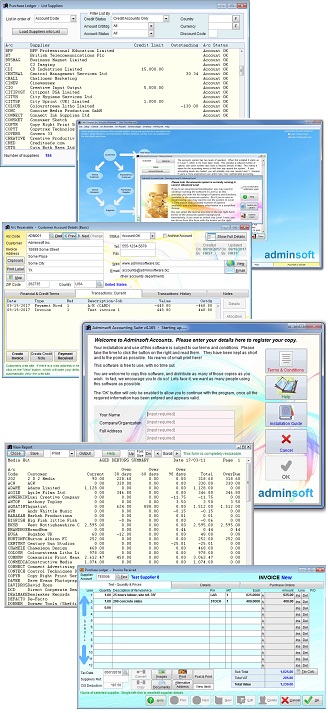

Customers, Invoicing, Statements, Estimates

|

|

Suppliers, Payments, Remittance Advices

|

|

Stock Control & Purchase Ordering Processing

|

|

Profit & Loss, Balance Sheet, Cash Flow, Budgeting

|

|

Human Resources and Payroll

|

|

Sales Prospecting

|

|

Sales Order Processing

|

|

List of all Main Features

|

| Special software extension for the autotrade:

|

|

AutoManager: Parts Sales and Workshop

|

| Special software extension for the retail trade:

|

|

Cafe/Shop Manager: for Restaurants, Cafes, and Shops

|

Basic guide for those who know nothing about bookkeeping and accounting.

If you have any questions, please email

sales@adminsoftware.biz

See Adminsoft Accounts in action here:

See Adminsoft Accounts in action here: